#12

Kiprono Kittony, EBS

BOARD CHAIR – NSE PLC

Public capital markets are an important economic instrument that, if well harnessed, have the unique potential to accelerate sustainable economic growth needed to broaden prosperity and reduce poverty. Deeper and more efficient equity and debt markets provide an effective and efficient way of mobilising domestic resources and international capital flows, providing enterprises with the much needed resources for growth, thus fostering long-term investments.

Despite the macro-economic headwinds that have characterised the global economy over the last two years, the Nairobi Securities Exchange (NSE) has remained resilient under the Board leadership of Chair Kiprono Kittony, following his appointment on 13th July 2020. Since taking up the position, Kittony has pursued strategic initiatives that have set up a strong foundation, and set the NSE on a path of accelerated growth and development.

The Chair has placed special focus on the reintroduction of the privatisation program in Kenya, that will see the country off-load a number of state-owned enterprises (SOEs). Kip, as he is fondly referred, is confident that a well-coordinated and time-bound privatisation program will enhance Kenya’s investment outlook, while enabling the government to raise significant resources to fund the National Budget, as well as other priority agendas, including affordable housing and agriculture development.

The renewed impetus by the government to use the capital markets to raise domestic revenue is a welcome development that will provide the necessary catalytic effect to increase the number of listings from both the public and private sectors. Kittony has been an advocate for increasing the size of the market through the listing of large state and private sector corporations. Through his efforts, the market is expecting at least eight listings in 2023, which will make the NSE a leading venue for capital raising in Africa.

In line with the NSE’s core mission of providing infrastructure solutions that enhance the efficiency and effectiveness of conducting financial market transactions in Kenya, Kip oversaw the development and launch of the Unquoted Securities Platform (USP) in 2021.

The USP is an automated solution for the trading and settlement of securities of unlisted companies. It provides a platform that enhances efficiency, transparency as well as liquidity in the unquoted securities market space in Kenya, allowing unlisted companies to trade and benefit from proper market valuations for their investments. The critical innovation also supports Kenyans holding shares in savings and co-operative societies.

One of the critical challenges that face securities exchanges globally is reduced activity, which arises in periods of economic uncertainty. This tends to affect shareholder value significantly, as trading activity has a strong correlation with revenue and profitability. To address this, Kittony has spearheaded initiatives that support the NSE‘s growth from non-trading income. For example, the data and information service line has recorded growth in excess of 40 percent over the last two years. This is significant, and is playing a critical role in cushioning the NSE from revenue shocks arising from challenges affecting global markets.

A few years back, the Kenyan Corporate Bond Market faced challenges, following the failure of two banks that had raised debt capital through the market. As an important capital raising platform, the corporate bond market needed to address credibility-related challenges and restore investor confidence. Since Kittony took on the Chairmanship, the market has recorded a strong recovery, with four new issuances valued at KES 19.4 billion listed on the NSE. The recovery and performance of the bonds underscored renewed confidence in the corporate bond market by both issuers and investors. It equally cemented the attractiveness of the Kenyan capital market as a capital raising avenue for enterprises seeking long term debt capital in Kenya.

Maintaining a strong and credible public perception is key in driving capital inflows into the country through the NSE. Kittony has taken a personal initiative to promote the market and strengthen NSE’s global positioning through various media and publicity initiatives both locally and internationally. These initiatives have seen the NSE grow its global profile and receive acknowledgement in thought leadership discourses, that seek to enhance the growth and development of frontier markets.

In an effort to enhance inter-Africa trade and ride on initiatives under the Africa Continental Free Trade Area (ACFTA), the NSE has joined six other exchanges in launching the Africa Exchange Linkage Project (AELP). AELP, established in November 2022, aims to enhance cross border trading across exchanges in the continent, subsequently increasing liquidity of African markets and promoting regional offers in Africa.

Under Kittony’s tenure, the NSE has launched its Environmental, Social and Governance (ESG) Disclosures Guidance Manual. By issuing these guidelines, the NSE aims to improve and standardise ESG information reported by listed companies in Kenya. The guidelines provide a granular, tactical approach to ESG reporting that meets international standards. They also detail how listed companies can integrate ESG considerations into their organisations, helping capture significant opportunities for stakeholders while managing critical business risks.

Kittony has engaged various companies, aggressively promoting the adoption of sustainability through advocating for the application of the ESG Disclosure Guidance Manual; use of green financing instruments like green bonds to fund infrastructure projects in Kenya; and the proposed development of a carbon trading exchange in Kenya.

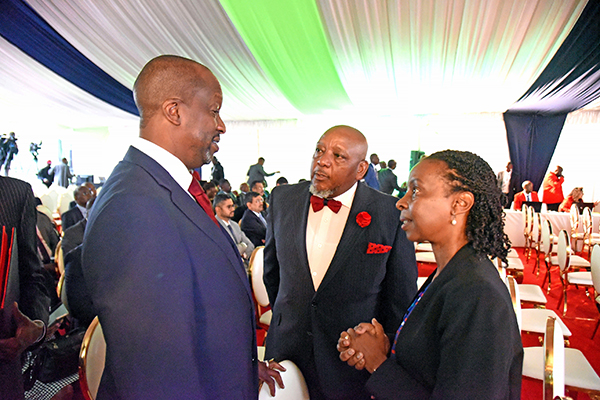

In October 2022, the NSE Market Place was launched, with the objective to revive market activity and boost the growth of the stock market. It provides a platform for Kenya to communicate investment opportunities to the world, positioning the country as a hub for trade and investments, and attracting Foreign Direct Investment (FDI) across various sectors. The launch was held at a bell ringing ceremony officiated by the President of Kenya, HE William Samoei Ruto.

The Real Estate Investment Trusts (REITs) market is a key platform for the real estate sector in Kenya. In the last two years, the NSE has listed the Acorn Development and Income REITs, whose funds are targeted towards the development of student accommodation. The two REITs were the first securities to be quoted on the NSE USP platform. To date, the total amount raised through this instrument totals KES 4.9 billion.

Looking to 2023, Chair Kittony is optimistic of the unique opportunities for the growth and development of Kenya’s public capital market. His focus is to keep the business focused on its key mandate of linking capital to opportunities, supporting companies to raise capital, whilst providing Kenyans an avenue to save and create wealth.

In keeping with this, Kip is keen on guiding the Board and Management of the NSE as they work closely with the government and its agencies to pursue the privatisation of companies, as guided by HE the President, and promote Kenya’s economic outlook.

Equally, guided by the President’s directive, Kittony will steer the NSE as it focuses on enhancing ease of market access by retail investors.

Far from his activities surrounding the NSE, Kittony holds several board positions. These include, but are not limited to: Founding Chair of the Radio Africa Group; Vice Chair of the World Chambers Federation in Paris, France (where he represents Africa); Chair of My Jobs in Kenya; Chair of Mtech Communications; Chair of CreditInfo CRB Kenya; and Director and Member of advisory council of International Fund for Health in Africa (IFHA).

Kittony holds two degrees from the University of Nairobi (UoN): Bachelor of Commerce (BCom) and Bachelor of Laws (LLB). He also holds a Global executive Master of Business Administration (GeMBA) degree from the United States International University Africa (USIU-Africa), in conjunction with Columbia University.

On Jamhuri Day 2020, Kiprono Kittony was awarded the Elder of the Order of the Burning Spear (EBS) by President Uhuru Muigai Kenyatta, for his contribution to the country, in the sphere of business leadership. Away from work, Kip enjoys spending time with his family, both in Nairobi and at his farm in Kitale. Additionally, he actively mentors the youth and regularly participates in several philanthropic projects.