#3

M-PESA

Happy customers are the heartbeat of any successful business, and their satisfaction is a testament to the brand’s commitment to excellence and innovation. This maxim finds resonance in the journey of M-PESA, the groundbreaking and currently leading mobile money service introduced by Safaricom in 2007.

Originating in Kenya, M-PESA has transcended its local origins to emerge as a global financial powerhouse, reshaping financial behaviours across countries such as Kenya, Tanzania, South Africa, Afghanistan, Lesotho, the Democratic Republic of Congo (DRC), Ghana, Mozambique, Egypt, Ethiopia, and beyond.

At its core, M-PESA is a revolutionary mobile phone-based financial service that facilitates the storage and transfer of money through mobile devices, breaking down geographical barriers and enhancing financial connectivity for users. Customers can send funds to friends and family, ensuring a hassle-free experience by allowing recipients to access the transferred funds at any M-PESA agent or withdraw money from designated ATMs.

As M-PESA evolved into a comprehensive financial hub, it introduced Lipa Na M-PESA, allowing users to seamlessly pay various bills, giving a very reliable alternative to debit and credit cards. The platform’s versatility extends to the Short-Term Paybill product, catering to diverse financial needs, enabling customers to raise funds for specific short-term requirements and highlighting M-PESA’s commitment to addressing the dynamic financial landscape.

M-PESA actively empowers small businesses with Pochi la Biashara, a product designed for business owners to manage business funds separately from personal funds on their M-PESA line, facilitating better financial planning for transactions.

In the realm of savings and loans, M-PESA offers products like M-Shwari and KCB M-PESA, providing users with the ability to save money and access micro-loans directly through the platform, contributing to financial growth and empowering users to navigate their financial journey with confidence.

Fuliza, a continuous overdraft service, addresses the unpredictability of financial situations, allowing M-PESA customers to complete transactions even when their accounts lack sufficient funds, ensuring uninterrupted financial transactions and underscoring M-PESA’s commitment to delivering customer convenience.

Moreover, through FARAJA, a zero percent interest credit service, M-PESA revolutionises the purchasing experience. Customers can buy goods and services, repaying within 30 days without incurring any interest charges. FARAJA benefits consumers and businesses alike, fostering mutually beneficial relationships and promoting financial flexibility.

M-PESA’s impact extends globally through its international money transfer service, M-PESA Global, allowing users to receive funds from abroad directly into their mobile wallets, fostering global financial connectivity and inclusivity. On the other hand, users can receive international money transfers through platforms such as Western Union, PayPal, Lemonade Finance (LemFi), among others.

In a strategic move to empower the younger generation, M-PESA introduced M-PESA Go, designed for children aged 10-17. This innovative product allows them to use M-PESA services under the guidance of their parents or guardians, promoting financial literacy and responsibility from an early age.

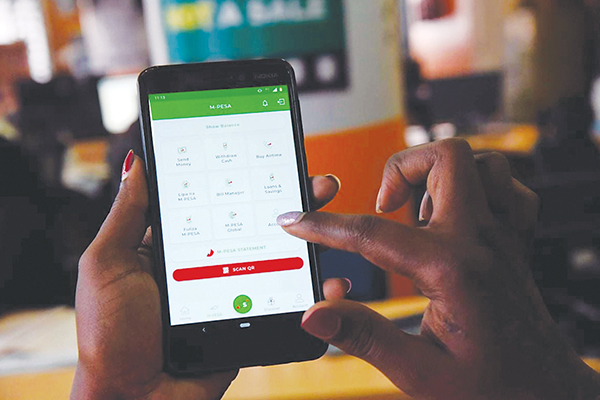

To empower customers in effectively managing their M-PESA transactions and enhance their overall experience, M-PESA introduced a revolutionary mobile application. Available for both Android and iOS users, the M-PESA app amalgamates all cherished features into one cohesive platform. Notably, the offline functionality allows users to log in and access key M-PESA features without an active data connection, prioritising accessibility. With a focus on security, the app has biometric authentication, eliminating the need for a PIN and enhancing transaction security through face or fingerprint recognition. One distinctive feature is the introduction of Mini Apps, providing direct access to various travel, lifestyle, and utility apps without requiring additional downloads. Users can effortlessly track their M-PESA usage in real-time, gaining insights through categorised daily and monthly reports.

Embodying its commitment to customer-centric innovation, M-PESA has partnered with BuuPass to launch an online service revolutionising how travellers in Kenya book and purchase bus tickets. Operational with five leading bus operators – Easy Coach, Modern Coast, Greenline, Palmers, and East African Shuttles – the service empowers customers to seamlessly plan their journeys, with payments effortlessly processed through M-PESA. The user-friendly interface allows customers to select preferred bus operators, travel dates, times, and even reserve specific seat numbers, fostering a sense of accessibility and convenience.

At the helm of M-PESA Africa is Chief Executive Officer(CEO) Sitoyo Lopokoiyit, overseeing operations across eight markets, with Ethiopia being the latest addition. Since assuming leadership in April 2021, Lopokoiyit exemplifies a commitment to the financial well-being of users across diverse regions, aligning with M-PESA’s ethos of customer-centricity.

M-PESA’s success narrative is intricately woven with its dedication to customer-centricity. As it continues to evolve and expand its footprint, M-PESA remains a trailblazer in the realm of mobile money services, reshaping the financial landscape for the better.