#23

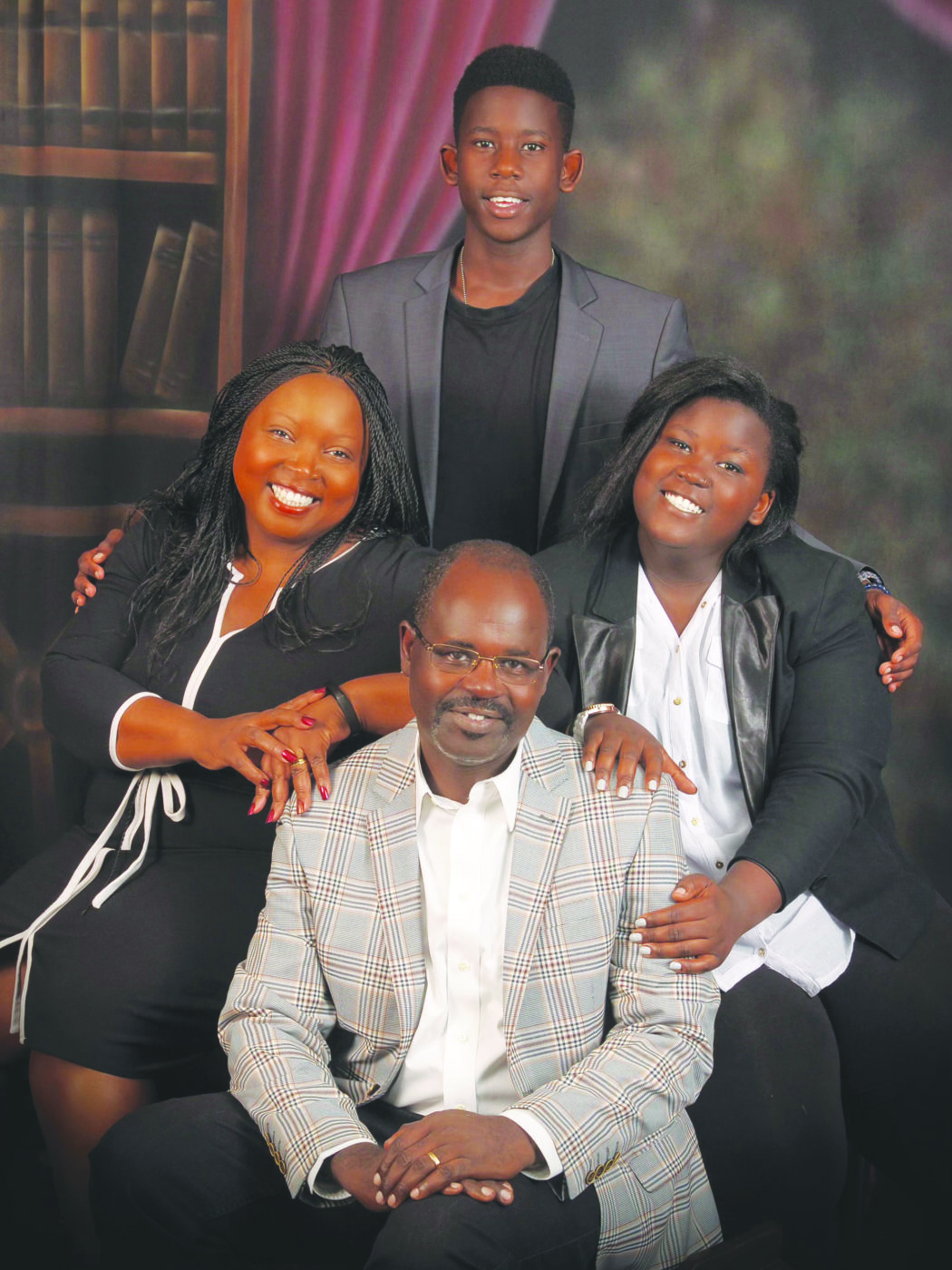

Dr Habil Olaka

CEO-KENYA BANKERS ASSOCIATION

Due to the adverse effects of the Covid-19 pandemic on the economy and indeed the social infrastructure in Kenya, bank customers have had to contend with a new normal: from all kinds and manner of inconveniences and liabilities.

From inability to service loan repayment obligations as a result of reduced income or job losses, to risks in the banking halls, delays in service delivery due to scaled down staffing and in some cases, closure of bank branches.

One person who has coordinated the reaction of banks as an industry, in addressing the adjustments to the changed environment and adhering to the constantly unravelling health protocols, is Dr Habil Olaka. The adjustments included a raft of financial interventions aimed at cushioning business and individual bank customers from the expected ravaging by the novel coronavirus, SARS CoV-2.

Guiding the banks, the Central Bank of Kenya 9CBK) through the monetary policy committee (MPC) reduced the cash reserve ratio by 1 % of deposits held by banks to release liquidity, in a bid to free more funds to the sector and protect the banking industry from the economic shock already being felt far and wide, as the industry geared itself to offer relief to an already grief-stricken customer base.

Through the concerted efforts by banks, businesses benefitting from these incentives extended these business mercies, by coming to the rescue of the micro, small and medium enterprises (MSMEs) through a number of initiatives, tools and frameworks, foremost of which was renegotiation of loan repayment obligations on case-by-case basis and extension of credit lines to mitigate the delays arising from late invoice payments.

In addition, the banking sector directly and indirectly through their agency platforms like the e-wallets, commenced cushioning Kenyans especially the most vulnerable sectors of the society, by removing fees charged on a number of transactions across different platforms.

Through the Kenya Bankers Association coordination, the banking industry undertook to extend relief on all current personal loans in the books (representing 28%) of the banking loan book, as on March 2 2020, where the individuals encountered repayment hardships such as poorly performing personal ventures, or loss of employment or illness arising out of the effects of the novel coronavirus, leading to no cashflow to service the personal loans.

Regarding the SMEs, the businesses were granted a window to approach their respective banks directly for analysis, after which depending on the merits of the case, have the loan repayment restructured, the costs of the restructuring bone by the respective bank on non-personal loans. The banks also waved the charges on bank balance inquiries.

These actions by the banking industry helped in stabilising the financial markets in an environment of massive unemployment, acute poverty and threats of mass famine among the most vulnerable communities. The banks managed to step up through their umbrella body led by Dr Olaka.

Dr Habil Olaka was appointed as Chief Executive Officer of the Kenya Bankers Association (KBA) in October 2010. Since then, Habil has been responsible for the strategic direction of the Association, covering industry advocacy, development and sustainability.

Previously, Habil was the Director of Operations of the East African Development Bank (EADB) based in Kampala after serving as the Resident Manager in Kenya. He earlier served the bank as the Head of Risk Management and as the Chief Internal Auditor. Before joining the Bank, he had been with Banque Indosuez (now Bank of Africa).

Habil started his career at the PricewaterhouseCoopers, in the Audit and Business Advisory Services Division.

Dr Habil Olaka sits on a number of boards representing the KBA. These include the Kenya Deposit Insurance Corporation, Higher Education Loans Board, National Research Fund, National Housing Corporation and the Anti-Money Laundering Advisory Board (as alternate to KBA Chairman).

He is the current chairman of the Federation of Kenya Employers (FKE) chairs the Public Finance Sector Board of the Kenya Private Sector Alliance (KEPSA) and the Board of Directors of Centre for Corporate Governance.

The engineer turned accountant turned banker holds a Doctor of Business Administration (DBA) degree from USIU-Africa, a First-Class Honours BSc degree in Electrical Engineering from the University of Nairobi, and an MBA in Finance from the Manchester Business School in the UK. His DBA dissertation was on the influence of strategic leadership on the implementation of strategy in the commercial banks in Kenya.

Habil is a member of the Institute of the Certified Public Accountants of Kenya (ICPAK) and the CFA Institute. He is an alumnus of the Strathmore School of Accountancy and has a good command of the French language.

Some of the initiatives he has overseen at the KBA include the cheque truncation project, credit information sharing initiative, chip and pin technology (EMV standards), the real time account to account transfer system (Pesalink), currency centres (four so far), sustainable finance initiative. He was the CEO of the Year 2018 by the Association of Bank Executives.

CITATION

- Strategic Leadership

- Corporate Governance

- Banking Industry Leadership

- Banking Product Innovation