BRITAM HOLDINGS

In 1965, Britam started out as a modest insurance outfit serving a newly independent Kenya. Sixty years later, it towers as a pan-African financial services powerhouse operating in seven countries and counting. As the company celebrates its 60th anniversary, the milestones continue to pile up. It has become the first Kenyan underwriter to cross the Ksh50 billion mark in gross written premiums in a calendar year.

Britam is also the first insurer to launch operations in a Special Economic Zone (SEZ), laying the groundwork for a pan-African innovation hub focused on financial services and startup investments. It’s also the first insurer to attain the Top Employer certification by the globally renowned Top Employers Institute (TEI).

For a record 18th consecutive year, it has bagged Life Company of the Year awards from the Association of Kenya Insurers (AKI), where it leads with a 25% Life Insurance market share. It is the largest microinsurance under-writer commanding over 40% market share and the second largest General Insurance company in market share. That topline performance has been matched by a strong operational backbone: in early 2025, Britam General Insurance settled a Ksh 71 million fire claim for Limuru Country Club within a month – proof of the Group’s commitment to its brand promise, fast and efficient claims settlement and dedicated customer support.

As one of the leading blue-chip firms on the Nairobi Securities Exchange (NSE) with a market cap exceeding KSh 16 billion, Britam continues to redefine the future of insurance, wealth management, and inclusive finance. For the 2024 financial year, Britam posted a pre-tax profit of Ksh 7.3 billion, a 52% increase from the previous year. This growth was not driven by short-term swings or one-off gains, but by deliberate decisions made over the past four years under Britam’s five-year strategic plan—known as EPIC².

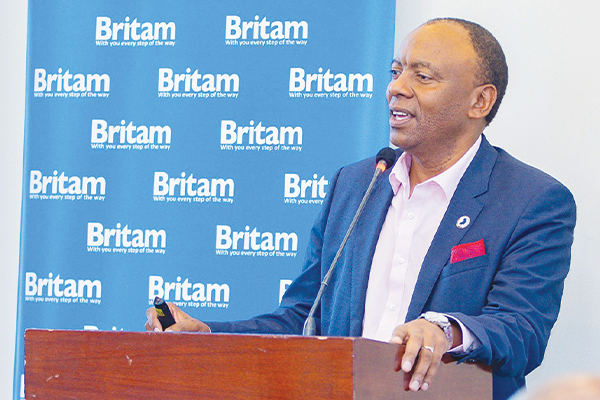

“We’ve remained consistent in our focus on operational efficiency, product diversification, and optimizing investment performance,” says Group Managing Director and CEO, Tom Gitogo. “The 2024 performance reflects not just a good year, but the compounding effect of strategic alignment.”

Britam’s insurance revenue rose to Ksh 37.6 billion, up from Ksh 36.4 billion in 2023, supported by steady topline growth across both the Kenyan market and regional subsidiaries. Notably, the regional general insurance businesses con-tributed Ksh 10.3 billion – 27% of total insurance revenue – affirming Britam’s long-term bet on geo-graphic diversification, the performance acting as a proof the Britam betting on Africa.

This blend of market strength and regional contribution is central to Britam’s strategy – not only as a risk mitigation tool but as a pathway to sustainable scale in a fragmented financial services landscape as it continues to eye entry into the DRC. Turning to investments returns, perhaps the most striking number in Britam’s 2024 results is the 163% rise in net investment income, reaching Ksh 30.6 billion. In a year marked by interest rate volatility and cautious investor sentiment, Britam’s asset management strategy focused on optimizing for competitive risk-adjusted returns – a move that paid off.

The balance sheet is equally robust. Total equity rose to Ksh 29.46 billion from Ksh 25.69 billion in 2023, reinforcing the group’s capital position and its ability to withstand macroeconomic uncertainty. 2024 marked the fourth year of Britam’s 2021 – 2025 strategy cycle – EPIC² – is the strategy behind numbers, focusing on employees, partnerships, innovation, customers and conduct. The plan has been less about disruption for its own sake, and more about disciplined transformation. Key to this approach has been embedding technology where it matters most: in customer experience, product delivery, and speed of execution. The rollout of Britam’s Marine Digital Portal, for example, has automated the once-manual process of marine cargo policy issuance – reducing turnaround times from days to minutes and improving broker and client satisfaction.

This year, Britam took a decisive step by scaling its corporate innovation hub – BetaLab – to the Two Rivers International Finance and Innovation Centre (Trific) Special Economic Zone (SEZ). The move is designed to deepen its engagement with startups and entrepreneurs shaping the future of insurance and financial services in Africa.

In under a year, BetaLab has incubated startups working on AI-powered motor claims assessment, SME financial management, and insurance products for boda boda riders. The success of BetaLab is proof of innovation as an engine of growth – the long-term objective being to seed the next generation of Africa’s financial infrastructure from within Britam’s ecosystem. On the claims front, Britam has also harnessed technology and analytics to fast-track claims processing and reduce fraud – ensuring faster settlements and improved trust with customers.

Britam’s leadership in financial services is underpinned by a broad-er commitment to sustainability and responsible business. In 2024, the Britam installed solar powered carports at its headquarters to reduce its carbon footprint and adopted global sustainability frameworks, to underpin its sustainability, climate risks and community development undertakings, in alignment with cli-mate and nature-related financial disclosures.

Britam is investing in innovative insurance solutions designed to help communities adapt to climate change. This includes climate risk modeling, the promotion of nature-based solutions, and the expansion of products that support carbon reduction and sustainable livelihoods.

In flood-prone Tana River County, Britam has pioneered climate risk cover – combining parametric insurance with humanitarian relief logistics in partnership with Oxfam. Through the Britam Foundation, the group has scaled up its community investment efforts. A partnership with Davis & Shirtliff now powers clean water access in over 20 rural schools through solar pumps, impacting nearly 30,000 lives.

Britam is deepening its presence in underserved segments – especially in the informal and gig economies. Its microinsurance arm, Britam Connect, represents a shift in how insurance is packaged, priced, and distributed with a mobile-first, embed into day-to-day financial behaviour approach. A digital taxi passenger can now receive personal accident cover per trip, or a street vendor can access health protection bundled into a mobile wallet top-up.

Beyond 2025 – the final year of the strategic plan – Britam’s priorities remain consistent: expanding financial inclusion and responding to customer needs with speed and relevance, improving the customer experience while sharpening the edge.