#23

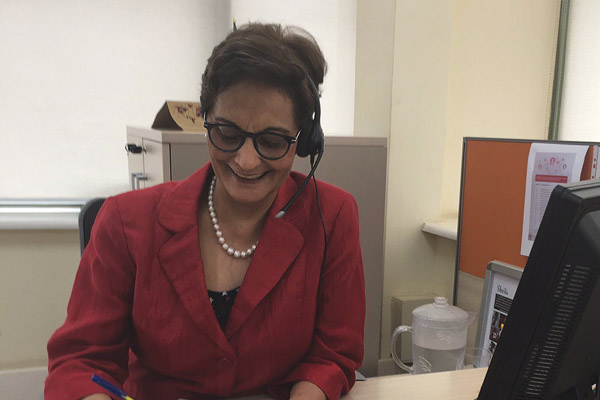

Nasim Devji

MD, DIAMOND TRUST BANK

Devji is one of five female CEOs of commercial banks in Kenya, as the MD of Diamond Trust Bank (DTB).

DTB is an award-winning tier-1 lender that is listed in the Nairobi Securities Exchange (NSE). DTB operates in EA except Rwanda. It recently has announced plans to open 17 new branches by the end of 2022 ostensibly as part of its expansion drive aimed at delivering increased customer value and foot prints in its operations.

As at December 31st 2021, DTB footprint indicates 570,867 customers, 352, 816 mobile banking customers, 129 branches with 150 ATMs and 2,156 employees.

The strategic expansion drive is expected to complement the group’s business growth strategy and underpin its premier position as one of the leading financial institutions in East Africa. The increase in branch outlets is aligned with DTB’S efforts to deepen its market presence in the fast-growing region of Eastern Africa and create increased value through its assets as it looks beyond 2022.

This addition will increase DTB’s branch network in Kenya from 63 to 81, while its total branch network across East Africa from 129 to 146.

In the midst of customers’ rapid adoption of online banking services and products, Devji, a leading businesswoman in her own right, states that move confirms DTB’s confidence in the Kenyan economy.

DTB, is optimistic about Kenya’s economic recovery post COVID-19 and the 2022 general elections. She adds that DTB is making strides to be closer to the customers in order to support them to attain their personal and business goals.

Linus Gitahi, chair of board of DTB, reinforces this thought trajectory, stating that the branch network expansion demonstrates DTB’s commitment to expanding its presence in the EA region in line with its growth strategy. He adds in a special article in the Billionaires Africa, written by Omokolade Ajayi, and which we heavily quote below, for this write-up, “The investments we are making are not only a sign of the bank’s financial strength but also a sign of our commitment to creating more convenience for our customers. As a tier-one bank, we are keen on increasing our market presence as this underpins our growth strategy.”

DTB net earnings increased to Ksh 4.4 Bn in 2021 compared to Ksh 3.5 Bn over a similar period in 2020, representing an increase of 25.7%. The Group’s loans and advances to customers increased to Ksh 220.4 Bn in 2021 from Ksh 20.6 Bn in 2020. Customers’ deposits increased to 331.4 Bn in the same period, up from 298.2 Bn in 2020.

Shareholders Equity, what owners of the firm would be paid were DTB to be liquidated, increased to Ksh 67.3 Bn in 2021 from Ksh. 61.9 Bn in 2020. The bank has been in operation for more than 75 years.

Devji became MD at DTB in 2001 and is one of five female CEOs at Kenyan commercial banks. The other four are Betty Korir, CEO of Credit Bank; Rebecca Mbithi, CEO of Family Bank; Anne Karanja, CEO of Kenya Post Office Savings Bank; and, Joyce Ann Wainaina, CEO of Citibank Kenya.

Ms Devji is a Fellow of The Institute of Chartered Accountants of England and Wales. She is an Associate of the Institute of Taxation (UK) and Fellow of the Kenya Institute of Bankers. She is a Member of the Institute of Directors (Kenya).

Nasim is Board Member at the Nairobi Securities Exchange (NSE), Jubilee Insurance Burundi, Diamond Trust Insurance Agency, DTB Tanzania, DTB Uganda and DTB Burundi.

She has been recognized as the ‘Leading African Woman in Business of the Year’ at the 2010 Africa Investor Investment and Business Leader Awards, ‘CEO of the Year’ award from the Capital Markets Authority in 2011 and 2014, and ‘Chief Executive of the Year in Banking’ during the Banking Awards (2011 and 2013).

Ms Devji was recently ranked among the 2021 Top 100 Women CEOs in Africa by Avance Media and Reset Global People in support of the United Nations Sustainable Development Goals.

Nasim is passionate and active locally on issues being pioneered by the UN Global Compact and especially in support of the recently launched UN Global Compact African Strategy 2021-2023, with the theme: Mobilizing African Business for Impact. She recently posted the launch, on LinkedIn, that was hosted by UN Global Compact Network Kenya. The strategy is key in advancing corporate sustainability and scaling up responsible business practices across the continent, while upholding the Ten Principles of the Global Compact focused on the areas of human rights, labour, environment and anti-corruption.