#6

APA

With a brand promise of ‘Insuring Happiness,’ TheApollo Group’s CEO, Ashok Shah, describes how one of East Africa leading financial services companies, has been shaking up the insurance industry through its business model innovation and digital transformation, while putting their client’s happiness at the core of everything they do.

When I joined The Apollo Group in the 1980’s, my aim, with the team, was to build a company that was focused on creating a positive impact. The Apollo Group has now grown to become one of East Africa’s most impactful financial services providers. The Group provides innovative products and services in Insurance, Pensions and Investments. It is built on the key pillars of customer focus, commitment, integrity and innovation. The Group comprises of APA Insurance Kenya and Uganda, APA Life Assurance, Apollo Asset Management and Gordon Court; with shareholding in Reliance Insurance Tanzania.

Transformation is in the Apollo Group’s DNA. Indeed, it is at the heart of the business and has taken many shapes and forms – from creating innovative products and services, to becoming the first insurance company in Kenya to cover HIV and more recently Covid-19, to creating one of the leading socially responsible foundations.

Though all the changes, the Apollo Group has not wavered from the original overarching purpose of protecting its valued clients, their investments, growing investor savings through skill and diligence, while being a force for social good.

The story of Apollo Group’s transformation journey is best described across five key areas, driving the Group to where it is now and acting as a compass for its future.

Customer centricity

A focus on our clients and their needs forms the core of our business. Our client-centric approach aims to create products which fully engage the clients, bring positive change in their behaviour and offer real value. From creating innovative, inclusive products that give personal cover for example to Boda and Tuk Tuk riders for as little as 1 bob a day to embedding Political Violence and Terrorism for large and small businesses.

In 2000, the Apollo Insurance announced that we would provide cover for HIV, when no other insurer was willing to do so. This was also identical for the recent pandemic as we were one of the first insurance companies to cover Covid-19 treatment to the full extent of policy cover. It was an expensive decision; however, we found that many of our insureds would never have been able to pay the steep bills from the hospitals, were it not for us to guaranteeing their bills to our policy limit.

One of most important lessons from the Covid-19 pandemic is proactive preparation for the unexpected. Together, with the greater than ever focus on the importance of health and wellness, the rising trends of technology adoption growth opportunity has been profound.

Our People

Our people are the backbone of the Group, connecting all the different parts and functions and the growth towards meaningful impact. Through our people, we have developed innovated products that are good not only for the company but also for our customers and the economy. We have a growth mindset and put client needs at the heart of our decisions, embrace digital opportunities and focus on sustainable, commercial, and financial outcomes. We aim to bring our entire organization closer together as one and leverage strengths across the Group to be a strong partner for our valued clients.

Our people invest in us and us in them. We invest in our people’s knowledge and capacity through skill development programmes and training opportunities which are mutually beneficial.

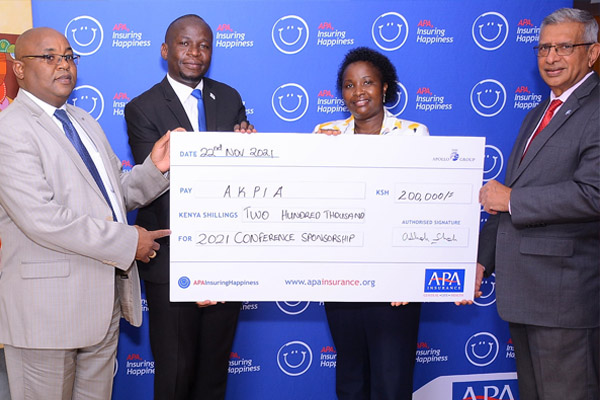

Our Partnerships

We value our partnerships. They are the link between us and our mutual clients. They create convenience for our customers; which we acknowledge to be one of the cardinal needs in this fast paced world. They are vital in the creation and sustenance of our relationships with our clients. We have built strong relationships with our brokers and agents, small and large, who play a pivotal role in the growth of our business.

Technology is an enabler of convenient service, not all insurance products can be sold from end to end online. While digital channels are essential, their inability to provide in-depth, personalized advice to customers seeking complex products such as retirement plans and annuities emphasize the significance of agents and face to face conversation, when investing in these types of insurance solutions. Given this, as totally essential, we continue to grow and maintain a robust broker/agent network.

Innovation

Central to our business is staying relevant in changing times. Innovation enables adaptability to evolving markets, to expanding and changing needs and makes us more available to our clients.

The Group underwrites General Insurance risks such as Health, Motor, Liability, Agriculture, Livestock, Marine, Aviation, Property and Micro Insurance. We have developed a strategic focus in Inclusive insurance spanning from micro-insurance, agriculture and livestock insurance and have various other products to protect vulnerable communities, and those marginalized by economic factors and also against climate related risks.

We have played an essential role in the development of a strong agricultural insurance market in Kenya. The Apollo Group partners with other like-minded industry players, NGO’s and the Kenyan Government to provide inclusive insurance for the betterment of the economy. The inclusivity aspect is close to our hearts because it fulfils our vision to make meaningful impact, to improve the socioeconomic status of various marginalized groups and in the bigger scheme of things, to improve the economy of the East African community. Developing the right kinds of products and partnerships has been an exciting challenge and it requires a lot of patience in both design and experimentation that ultimately impact people’s lives. There are two main products which have been very successful – Kenya Livestock Insurance Programme (KLIP) and Area Yield Index Insurance (AYII).

Kenya Livestock Insurance Programme (KLIP) provides Index-based Livestock Insurance (IBLI). With insurance payouts, pastoralists are able to purchase feeds for their livestock during the drought and carry on with their traditional livelihood. Area Yield Index Insurance (AYII) is a solution that pays out claims to group of farmers when the average yield in their area falls below a set level, regardless of the actual yield on each client’s farm. The AYII being the most extensive agricultural insurance protects farmers against the damage to the insured growing crops due to excessive rainfall, food, frost, hail damage, excessive heat wave, windstorm, uncontrollable pest and diseases, and drought.

Through these initiatives, farmers have been insured and claims worth over Kshs 200 million paid following the 2021 short rains season. This has provided financial support to farmers in the event of losses arising from major agricultural shocks. It has also minimized or eliminated the need for emergency assistance provided by the government during periods of agricultural disasters.

Apollo Group has been fortunate to be recognized as a leader in the private sector in Micro insurance, Agriculture and Livestock insurance.

APA received recognition and a grant worth US$2.49M from MasterCard Foundation under its Fund for Rural Prosperity (FRP) program. With this partnership, APA created a programme dubbed Micro-Sure programme to scale up the uptake of insurance among the largely financially excluded population – that includes smallholder farmers and small and micro traders. Since 2017, over three million low-income people have accessed and used insurance through APA’s agriculture, livestock and non-agriculture insurance products.

In November 2019, APA received the 10th European Microfinance Award for “Strengthening Resilience to Climate Change” through its index-based agriculture insurance to cover yields and for livestock through KLIP, thus providing farmers with a safety. This is the first time an insurance company has received the award.

APA also introduced Hospitalization Cash, an income supplement, which offered reprieve to clients during the unfortunate moments of sickness/hospitalization denying those earning opportunities. These products have often been innovatively bundled to provide multiple benefits for very affordable premiums across board. This has helped to create a much-needed impetus for scale and increased insurance penetration.

A Force for Social Good

The Apollo Group and the APA-Apollo Foundation in alignment with the social and humanitarian values of the Group, aim to strengthen societal resilience in East Africa.

Established in 2006, the Foundation approach now mirrors the United Nations Sustainable Development Goals (SDGs) which aim to help end poverty, protect the planet and ensure that all people enjoy peace and prosperity by 2030. The SDGs are the blueprint to achieve a better and more sustainable future for all.

The Foundation’s water projects involve Environment Conservation and Water Harvesting through construction of sand dams, water tanks and shallow wells. The APA Apollo Foundation has constructed 35 dams in various counties in Kenya with a total value of Ksh175 million. It has supported needy children with fully paid secondary education. Environment and Youth are the other 2 pillars.

As a business, The Apollo Group’s Brand continues to strive for excellence in all its elements and brand building equity, and in everything we do. As such, APA believes that it is making a positive difference to our clients and to society at large.

This additional recognition reminds us, at APA to ensure that we continue to innovate and continue to fulfil our promise of ‘insuring happiness’ in newer and more exceptional ways.