#1

NCBA BANK

Welcome to the brand that banks on your ambition. Welcome to the bank with the slogan, “Go For It.”

NCBA Bank’s slogan is more than just branding – it’s a commitment to walk alongside customers, supporting their financial goals and fuelling their progress through tailor-made solutions, a human touch, and bold, innovative financial products, all set against the serene ambiance of the NCBA Bank experience.

Across towns, cities, and rural hubs, NCBA Bank is steadily building not just branches, but lifelines. The recent opening of its Tatu City and Ukunda branches, for instance, marks more than just a physical presence – it is a declaration of intent: NCBA Bank is here and ready to partner conveniently with customers, whether online or right at their doorsteps. From the salaried employee seeking a soft or long-term loan, to the entrepreneur in need of immediate working capital or asset financing, and the everyday customer searching for a banking experience that truly understands and adapts to their journey – NCBA Bank’s approach is clear: be present, be responsive, and make financial services feel like a natural extension of everyday life – not an interruption.

At the heart of NCBA Bank’s strategy is a seamless, ‘phygital’ experience – a blend of physical and digital touchpoints that gives customers options, accessibility, and autonomy. The bank’s top-rated NCBA Now app provides everything from real-time account management to instant loan applications, while allowing customers to walk into a branch when they want a conversation, guidance, or face-to-face service. Whether you are tech-savvy, a conservative or more traditional, NCBA Bank is the space where every customer feels noticed, supported, and valued.

NCBA Bank stands out for its ability to move with its customers as their lives evolve. Whether it is launching a solar leasing product to help businesses cut costs and go green, or providing flexible financing to support the purchase of premium vehicles through partners like Inchcape, the bank adapts its products to align with customer dreams – big or small. The bank is not in the business of pushing products; it is offering financial solutions to real-life problems with a flexibility that feels rare in banking in sub-Saharan Africa (SSA).

The recent profit of KES 21.9 billion is impressive, but even more telling is the milestone of over KES 1 trillion in digital loan disbursements. That scale of impact – across 60 million customers – is proof of the bank’s earning its place as a market leader in digital banking, asset finance, retail and corporate financing solutions. Impressively, NCBA Bank is doing this seamlessly without compromising its customer-first values.

It is no surprise then, that NCBA Bank was ranked second overall in customer experience among Tier 1 banks in 2024. It was named Best Bank in Customer Experience by the African Bank Awards and SME Financier of the Year-Africa by the International Finance Corporation (IFC). These accolades are not just about service; they are about trust. The kind of trust that turns customers into loyal ambassadors.

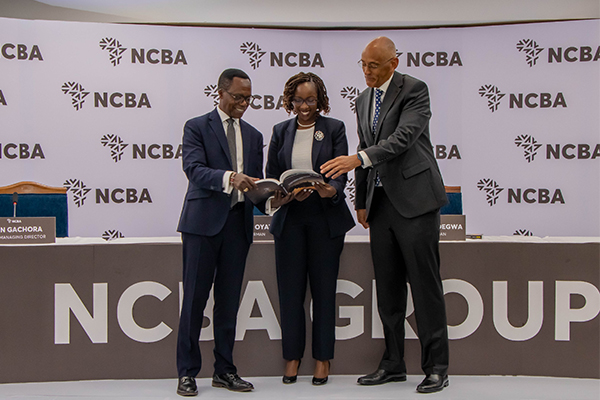

Ultimately, the power behind all this progress is leadership that understands that ambition must be matched with intention. Group Managing Director (MD) and CEO John Gachora is steering NCBA Bank and indeed the entire NCBA Group, with clarity and purpose, aligning bold financial performance with deep societal impact. “We remain focused on driving efficiency, deepening customer relationships, and leveraging digital channels for sustainable growth,” he stated during the release of the bank’s 2024 results. Under his leadership, the message is unmistakable: this is a bank that listens, learns, and leads with a human heart and a management edge.

According to a May 7, 2025 article by McKinsey & Company, heavily lifted in writing this paragraph, nearly half of a company’s performance is tied to the CEO’s leadership…only the CEO has the holistic perspective to assess the level or resilience, increase it, and integrate it into the organization’s DNA. John Gachora’s strategy for championing mergers of firms with nearly the same muscle (CBA and NIC) and acquisitions of strong firms (AIG) coupled with hiring and developing people who show adaptable traits and behaviours ( for instance Nelly Wainaina)…then serve as a role model for them himself…setting a common vision and creating a North Star that galvanizes the executive team, better exemplifies the pursuit of the kind of resilience that protects and sustains corporations.

Not to be forgotten, at the middle-management level, the prestigious Strathmore Business School (SBS) recently launched a custom programme for NCBA relationship managers, the Relationship Managers DNA Programme (RM DNA). This transformative programme will see SBS train more than 450 relationship managers from across the NCBA Group. The programme is to equip the participants with the skills, mindset, and leadership capabilities to thrive in today’s dynamic financial landscape.

The programme is anchored on five key pillars:

- Understanding the NCBA RM

- Customer Obsession

- Delivering the NCBA Customer Promise

- Business Acumen

- The RM of the Future

More than just training, this initiative is about building future-ready professionals who lead with empathy, integrity, agility, and wisdom. From role-playing exercises to coaching and personality insights, every aspect of the programme is designed to spark growth and drive lasting impact, ensuring customer obsession becomes a way of life.